[ad_1]

(Bloomberg) — Micron Technology Inc., the largest U.S. maker of computer memory chips, is on track for its biggest profit in more than 12 years after offering a surprisingly strong revenue forecast for the current quarter, boosted by the demand for artificial intelligence hardware.

Bloomberg’s Most Read

Fiscal third-quarter revenue will be between $6.4 billion and $6.8 billion, the company said in a statement Wednesday. That compares with an average analyst estimate of $5.99 billion. Micron will earn earnings of about 45 cents per share, less certain items. Analysts projected 24 cents.

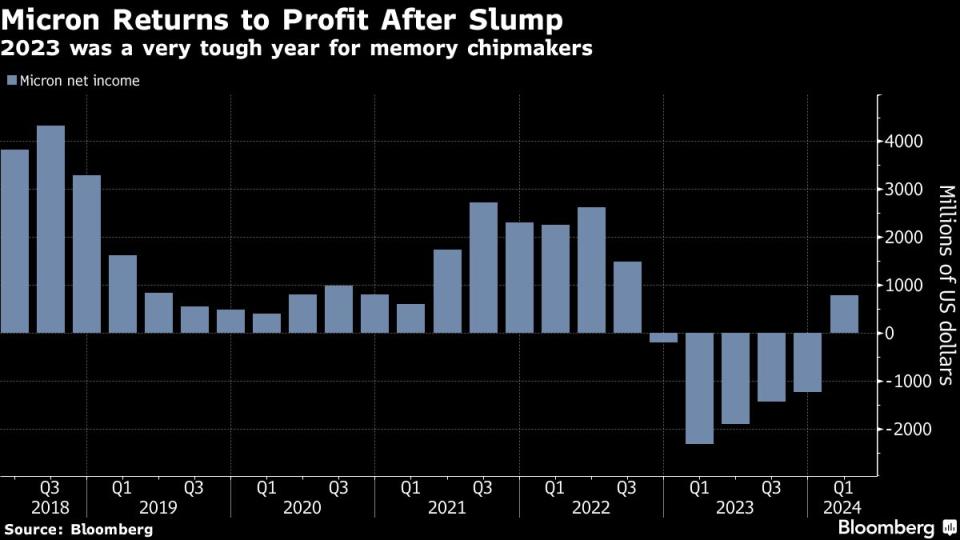

Micron and its rivals are emerging from one of the worst slumps the memory chip industry has ever suffered, caused by weak demand for personal computers and smartphones. But executives are optimistic about the future, as the booming market for artificial intelligence equipment helps chipmakers regain growth and profitability.

“We believe Micron is one of the largest beneficiaries in the semiconductor industry of the multi-year opportunity that AI provides,” CEO Sanjay Mehrotra said in the statement.

Shares rose 18% to $113.30 in premarket trading Thursday. If the gains hold, Micron will be on track for its biggest jump since December 22, 2011 and reach its highest level on record. They were up 13% to $96.25 this year through Wednesday’s close.

Mehrotra has promised investors that 2024 will mark a rebound for the industry and that 2025 will see record levels of sales. But Micron will need to produce enough ultra-fast memory, which is powered by Nvidia Corp. chips, to help data center operators develop artificial intelligence software.

AI-related systems use something called high-bandwidth memory or HBM. That type of chip is new and less of a commodity. That means companies like Micron can charge a much higher price for it.

Micron made its first revenue from a form of this memory known as HBM3E in its most recent quarter. The semiconductors are part of AI accelerators based on Nvidia graphics chips, Micron said. And Micron expects “several hundred million” revenue from HBM products in fiscal 2024. Most of its production of such chips is sold out by 2025, he said.

AI software is created by bombarding the software with information. The process can involve trillions of parameters and is highly dependent on memory. To avoid bottlenecks and keep expensive processors running at full capacity, Micron and its competitors have developed chips that communicate with other components much faster than traditional memory chips.

Nvidia CEO Jensen Huang said earlier this week that HBM was more than just a memory upgrade: It’s a vital technical marvel for artificial intelligence systems. He cited Micron as a leader in bringing new technology to market.

In the second quarter, which ended Feb. 29, Micron’s revenue rose 58% to $5.82 billion. The Boise, Idaho-based company earned earnings of 42 cents per share, excluding certain items. That compares with estimated sales of $5.35 billion and a projected loss of 24 cents per share.

“Micron has returned to profitability and delivered a positive operating margin a quarter earlier than expected,” Mehrotra said in a conference call with analysts.

Micron competes with Samsung Electronics Co. and SK Hynix Inc. of South Korea in selling chips that provide short-term memory in computers and phones. Micron also makes flash memory, which provides long-term storage in those devices.

Both types of memory follow industry standards, meaning parts from different companies are interchangeable and can be marketed as commodity products. The downside is that prices can be volatile and customers may switch from one provider to another.

Memory chip makers have been trying to enter new markets, such as data centers, cars and a growing range of devices, making them less dependent on phones and computers. But they have not diversified enough to offset swings in demand within their core markets, as they experienced in 2023.

Micron expects steady orders from personal computer and smartphone makers again. Many of them had reduced demand to reduce the inventory they had on hand. Weak orders from those customers caused chip prices to fall below the cost of production last year.

Earlier Wednesday, the U.S. Commerce Department announced it will provide Intel Corp. with $8.5 billion in grants and up to $11 billion in loans to help finance the expansion of its U.S. semiconductor factories. The announcement was the largest outlay yet from the Biden administration’s Science and Chips Act. So far, no other major chipmaker has been publicly promised support.

Micron said it will keep its budget for new plants and equipment for fiscal 2024 at $7.5 billion to $8 billion. It will continue with projects in China, Japan and India. The proposed expansions in the United States (in New York State and Boise) “require that Micron receive a combination of sufficient Chips grants, investment tax credits and local incentives to address the cost difference compared to the expansion in the foreigner,” Mehrotra said.

Most Read Bloomberg Businessweek

©2024 Bloomberg LP