[ad_1]

Foodtech and fast commerce decacorn Swiggy is reportedly looking to turn profitable in the second half of this year. However, going by the FY23 results, it still seems like a distant dream as the company’s losses crossed Rs 4,000 crore during the same period.

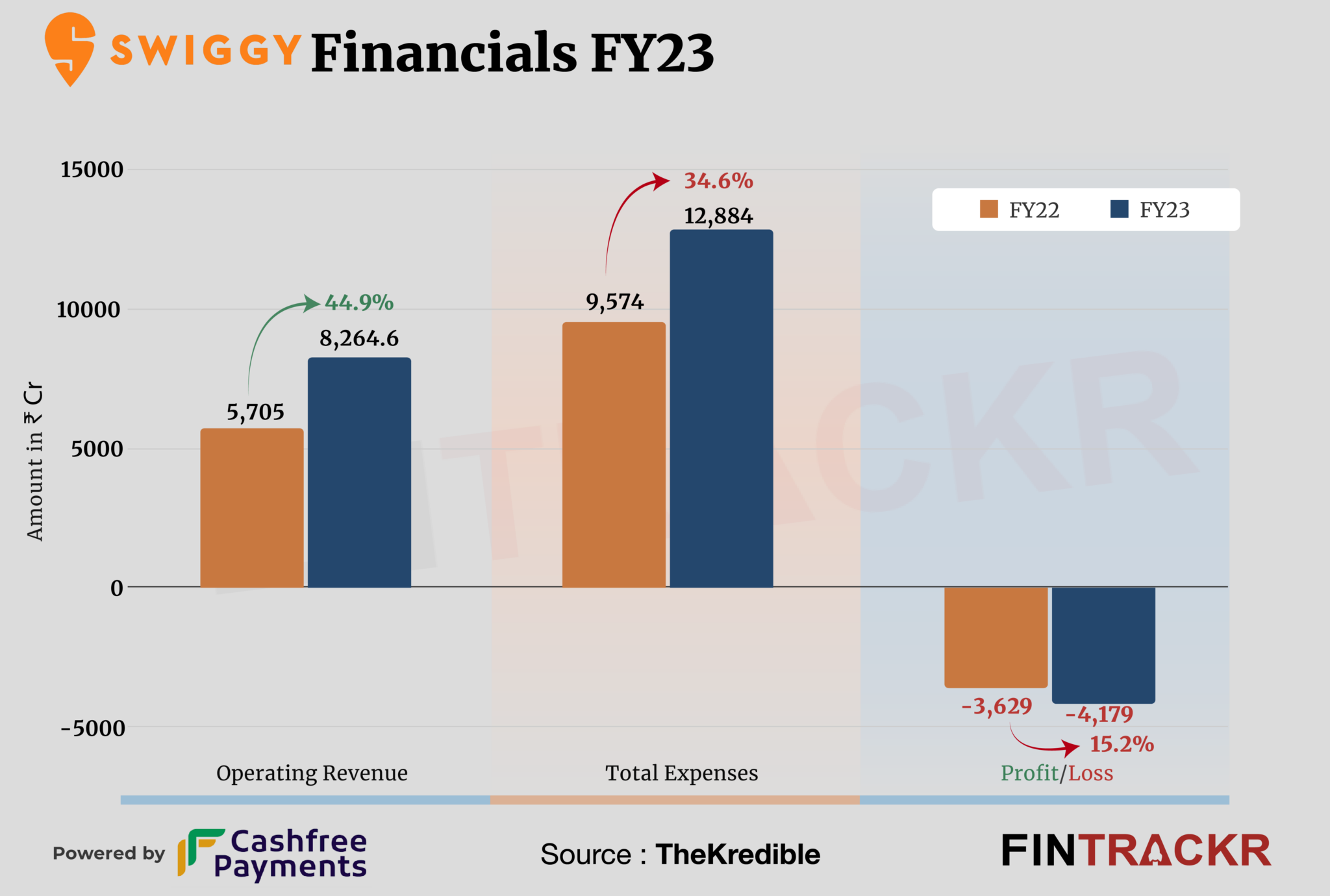

Swiggy’s operating income (gross revenue) grew by 44.9% to 8,264.6 million rupees during the fiscal year ended March 2023, compared to Rs 5,705 crore in FY22, according to the company’s annual financial statement with the Company registration.

Swiggy generates revenue through its online platform services, including order facilitation fees, delivery revenue, advertising revenue from sponsored listings, onboarding fees for partner merchants, subscription fees and revenue from food sales and traded goods.

The food technology company earned more than 50% of its revenue through platform services, followed by the sale of grocery products, which accounts for around 40% of revenue. The rest came from food sales and other operational activities.

Swiggy also earned Rs 372.5 crore from the sale of supply chain services during FY23. Additionally, it also earned Rs 450 crore from interest and profits on financial assets, taking the total revenue to Rs 8,714.5 crores in FY23.

according to elcredible, the purchase of inventories (after adjustment for changes in inventories) represented 26.2% of total expenditure. This cost increased 49% to Rs 3,381 crore in FY23 from Rs 2,268 crore during the previous year.

- Stock purchases

- Outsourcing Support Cost

- Advertising and promotions

- Employee benefits

- Storage and transportation

- Payment gateway

- Others

Outsourcing support cost was the other major cost, which rose 34.4% to Rs 3,159 crore during the period. Subsequently, the cost of promotional and employee benefits increased to Rs 2,362 crore and Rs 2,130 crore, respectively. Significantly, employee cost also includes employee share-based payment (cash settled) of Rs 534 crore in FY23.

Overall, the company’s total spend increased 34.6% to Rs 12,884 crore in FY23 from Rs 9,574 crore during FY22.

Visit elcredible for a complete breakdown of expenses.

In the end, the company’s losses increased by 15.2% to Rs 4,179 crore during FY23 as against Rs 3,629 crore in FY22. Additionally, the company’s outstanding losses stood at Rs 27,057 crore. at the end of FY23.

Cash outflows from the company’s operations stood at Rs 4,060 crore during FY23.

During the year, Swiggy’s EBITDA margin and ROCE recorded -43.90% and -42.93% respectively. At the unit level, the company spent Rs 1.56 to earn one rupee of operating income.

| EBITDA margin | -52.88% | -43.90% |

| Expense/Rupee of operating income | $1.68 | $1.56 |

| TOUCH | -26.78% | -42.93% |

Swiggy also grabbed the Headlines for a pair of rounds of layoffs in the past 12 months that affected more than 600 employees. It was also in news during the last fiscal year for consecutive increases in valuation.